Swindon has emerged as one of the best places in the UK to be financially secure, according to a survey based on wages and house prices.

The majority of towns and cities at the top of the list compiled by credit comparison site TotallyMoney.com are in the North, Scotland and Midlands – where homes are traditionally much cheaper than in the Southern half of the UK.

Swindon comes 15th in the list of 57 towns and is the third highest in the South after Luton and Peterborough.

TotallyMoney.com analysed criteria such as employment rates, average wages and cost of living to find the best places to live in the UK, from a financial perspective.

Swindon’s figures show a median monthly take-home salary of £1,915 and an average monthly mortgage repayment of £997.

Its relatively low unemployment – compared to Northern towns – of 4.1% and its buoyant local economy, with jobs growth of 4%, also counted in its favour.

TotallyMoney.com head of brand and communications Joe Gardiner said: “While scenery, shopping and a nice local pub are all important, people will always want to live in areas where they can be financially secure.

“This research shows us the true financial-health of an area, and that a town which offers high-paying jobs and expensive restaurants won’t necessarily be the best place to make a living.

“We hope this research will allow people to make more informed decisions when looking for somewhere to live and allow them to take steps towards improving their financial situation.”

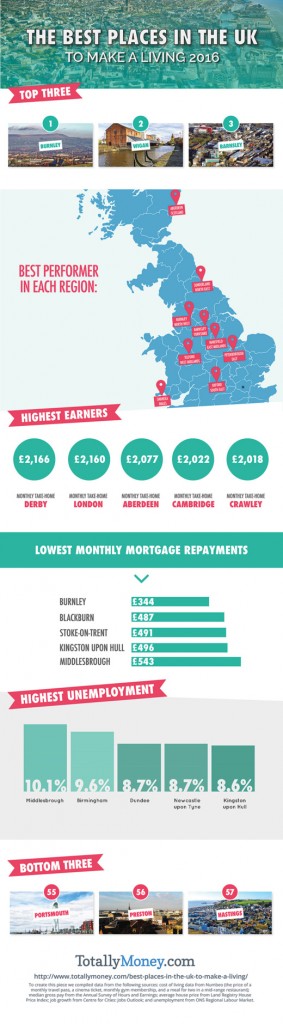

The Lancashire towns of Burnley and Wigan were in first and second place respectively.

The Sussex coastal town of Hastings was found to be the worst place in the UK to make a living.

In terms of living expenses, Wigan is the cheapest place to live in the UK, while London, unsurprisingly, is the most expensive.