Investment by foreign businesses into the South West rose last year despite the pandemic in contrast to a fall for the UK as a whole.

According to a new report by accountancy group EY, the South West achieved a 6.7% increase in Foreign Direct Investment (FDI) projects in 2020 – up by two to 32 on the previous year.

This helped the South West record a rise in market share for UK projects from 2.7% in 2019 to 3.3%.

Overall, the total number of FDI projects into the UK fell by 12% to 975 compared to 2019’s figure.

The EY 2021 UK Attractiveness Survey said while the South West’s performance only a modest rise in absolute terms, it represented a strong performance for the region in a contracting UK market.

It also meant the South West’s share of UK projects rose for the first time since 2017.

The report shows that the region’s performance was driven by its strength in key sectors, including in digital technology – seven projects in 2020, up one from 2019 – its joint highest total in the sector since 2016 and a contrast to the significant contraction in digital projects nationwide.

Business services recorded four projects – down one from 2019 – machinery and equipment ranked third in the region with four projects – up one from 2019 – and electronics and IT recorded three projects – up two from 2019.

While the South West secured additional projects compared to 2019, project numbers for the UK as a whole declined 12% – from 1,109 in 2019 to 975 in 2020. Meanwhile, the UK digital technology sector declined by 25% overall, from 432 projects to 322.

The South West was one of only four English regions to increase their project numbers. Out of all the UK region and constituent nations, the South West recorded the 11th highest number of projects.

Bristol remained a key location for FDI in the South West. Among the region’s towns and cities only Bristol featured in the UK’s top 20 locations for FDI projects in 2020, ranking in joint ninth (with Cambridge) having attracted 12 projects. London attracted the most projects in the country with 383 – down from 538 in 20.

Projects in the region were most likely to involve sales and service activities, which accounted for 17 projects, up from 10 in 2019. This was followed by manufacturing – six projects, down from seven. Research and development and logistics activities both accounted for three projects.

EY South West office managing partner Karen Kirkwood, pictured, said: “The South West has a diverse regional economy – perhaps one of the reasons that FDI projects are split between a number of sectors, with none being dominant.

“The manufacturing sector remains key for the region and despite the sector’s recent performance there are still positives in the research.

“Supply chain changes have created an opportunity to capture a larger share of investment in modern manufacturing, with almost half – 45% – of all respondents to our UK survey planning to change their supply chains, a figure that rises to 52% in consumer goods and 62% in the technology sector.

“With the manufacturing and logistics opportunities this will create, likely to fall outside of London and major cities, this may be a one-off opportunity to reshape the UK’s economic geography.

“Our research suggests the UK’s ‘levelling up’ message has landed effectively with investors, with almost two-thirds aware of the policy. Using a revised industrial strategy to shape a targeted policy offer based on specific local or sector opportunities should be a priority.”

The digital sector accounted for the largest number of projects in the UK every year since 2013. London remains the city driving the UK’s success in digital technology, securing 57.8% of all digital tech FDI recorded in the UK in 2020, or 66.5% when London and the South East are combined.

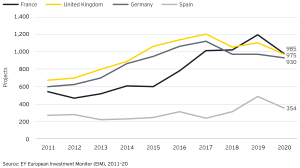

However, while the UK retained its leadership position for digital investment in Europe – securing 322 projects in 2020 and staying well ahead of Germany on 187 – project numbers fell by 25% from 2019 (432). This was almost double the fall in the overall European digital market (13%).

The UK’s decline in digital was not reflected in the South West, which managed to increase project numbers in 2020.